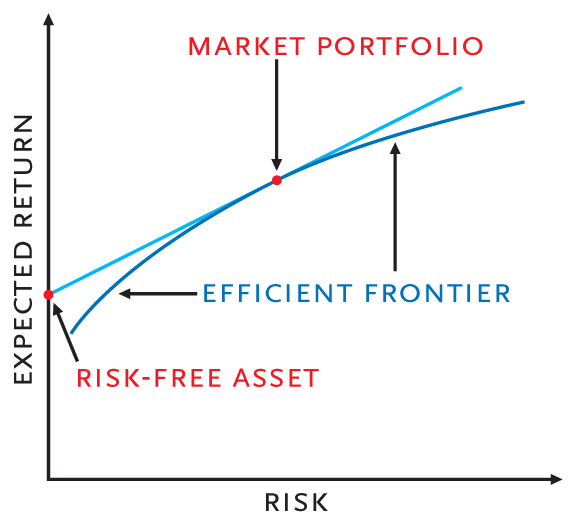

In both types, certain blood cells multiply out. so the CML has maximum slope/Sharpe Ratio. CML (capital market line) provides a profile that excellently merges the risks and rebounds. Chronic myelomonocytic leukemia (CMML) and chronic myeloid leukemia (CML) are two types of cancers that affect the blood and bone marrow. For the line, to move above the semi-parable is impossible, but if we move below (possible) we have the (inefficient) CAL.

in this framework the slope is the Sharpe ratio! This line is the CML and it is tangent with previous semi-parabola. The CML is a special case of the CAL where the efficient portfolio is the.

#CAL VS CML FREE#

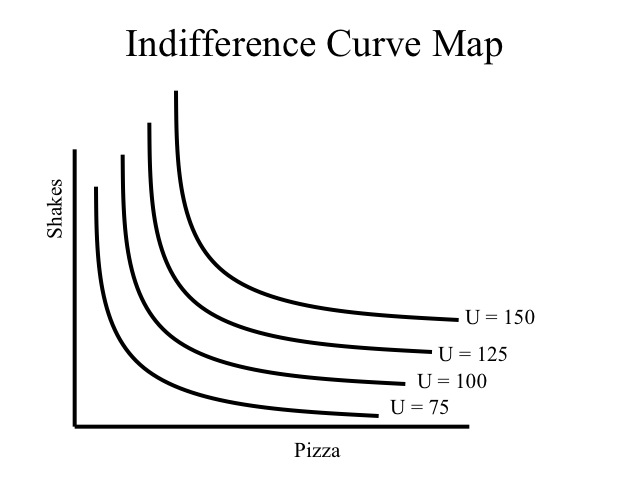

Other efficient portfolios are linear combinations between tangent portfolio and risk free asset. This is the optimal risky portfolio when all investors have the same expectations. The difference is also in terms of how they are denoted. One kilocalorie (kcal) has 1000 times more energy than one calorie, which makes it a large amount of energy in comparison to an actual calorie. Now every point/portfolio have only 1 risky component. The first difference between kcal and cal is the fact that both are units of energy but their values differ. If we have N risky asset + a risk free rate, we obtain, as efficient frontier, a straight line. However, to give the idea, if we have N risky assets we obtain, as efficient frontier, a semi-parabola and the weights of the countless efficient portfolio change point by point. We may move around this demonstration to explain most of portfolio theory. The Capital Allocation Line shows how an investor can use an optimal market portfolio matched to his risk preferences. 816, 916, 11-66, 1227 Deaves v CML Fire and General Insurance Co. Your question is very important! In formal way to demonstrate it is very interesting. 2-67 Daum v Superior Court Sutter County, 228 Cal App 2d 283 39 Cal Rpr.

0 kommentar(er)

0 kommentar(er)